COVID-19 Business Resources

Reprint from the Birmingham Business Journal:

A year of record unemployment claims due to the Covid-19 pandemic will lead to a sharp increase in the Alabama unemployment tax for the state's businesses and many nonprofit organizations.

The Alabama Department of Labor anticipates employers will see an increase of 77% to the unemployment tax to replenish the Unemployment Insurance Trust Fund that businesses pay into to fund unemployment claims.

Nearly 892,500 unemployment claims were filed from the start of the pandemic in March to the end of the year. The state paid $813 million in unemployment compensation benefits in 2020. That’s compared to $144 million in 2019.

Taxpayers will see an increase of $40 per employee per calendar year. The new rate will be effective throughout the year, and the first payment for the quarterly tax will be due in April.

Churches are exempt from the unemployment tax, but nonprofits with four or more employers are liable for the tax.

The increase is actually lower than some of the initial projections. The state was able to allocate $385 million from CARES Act funding to the Unemployment Insurance Trust Fund, which helped negate some of the impact.

Even though the increase is not as high as it could have been, the increase could still pose a challenge for a number of businesses still operating on thin margins due to the effects of Covid-19 – particularly those in the retail and restaurant world.

President Trump signed into law an update that was passed for the Paycheck Protection Program (PPP) and it will now be referred to as the Paycheck Protection Program Flexibility Act (PPPFA) which is aimed at helping small businesses with COVID-19 relief.

IF you have not applied and held off due to concerns that were in the original bill, now is a good time to relook at this option as the fixes that were made with this revision will go a long way to help you get running again AND with keeping records accurately, will help with forgiveness of payroll, rent, utilities and other expenses.

Here are the major changes in the revision as published today by Forbes.com[i]:

1. PPPFA changes amount of loan needed for payroll to 60% thus leaving 40% for other expenses.

The biggest complaint around the PPP loan program was that it required businesses to spend 75% of the loan on payroll. For those businesses shut down due to COVID-19, this meant playing the role of unemployment office, paying their workers to stay home and do no work. The PPPFA reduces the amount of the loan needed to be spent on payroll from 75% to 60%, thus increasing the amount of funds available for other expenses from 25% to 40%.

2. PPPFA extends time period to use funds from 8 weeks to 24 weeks which will be December 31, 2020.

The second biggest issue around PPP was that it required businesses to spend the funds in the eight-week period from the date funds were received. For a business shut down by government mandate, this amounted to spending funds when, perhaps, conserving them was in order. Business owners clamored to have the flexibility to spend the loan after reopening, especially on payroll when workers returned to work and were not sitting idle.

The PPPFA fixed this by extending the time period to spend the loans to 24 weeks. While businesses will still need to spend the money on payroll and authorized expenses, they now have until the end of 2020 to do so. Presumably, this will make receiving complete loan forgiveness more likely since the loan amount was based on one month of 2019 payroll multiplied by 2.5, which equals approximately 10 weeks. Businesses should now have the flexibility to spend the PPP funds when they like for the remainder of the year. And, another positive caveat: the PPPFA also does not require businesses to wait for 24 weeks to apply for forgiveness and can still do so after eight weeks if they prefer.

3. PPPFA pushes back a June 30 deadline to rehire workers to December 31, 2020

Small businesses took issue with the PPP requirement that all workers had to be rehired by June 30, 2020, in order for their salaries to count towards forgiveness. Many businesses were concerned they might not be open, or certainly not at full capacity by this date, and would once again, be required to pay employees for not working. Under the new law, businesses now have until December 31, 2020, to rehire workers in order for their salaries to count towards forgiveness.

It is important to note, however, that the law did not change how salaries are calculated towards forgiveness. The payroll calculation used in the loan application still applies to the forgivable amount. So, employee compensation eligible for forgiveness is still capped at $100,000, and until further guidance, employer owners and contractors are still capped at $15,385. Presumably with the new law, however, having an extra six months of expenses eligible for forgiveness will make up for any gaps and ensure 100% forgiveness of the loan.

4. PPPFA eases rehire requirements

The intent of PPP was to keep the same number of employees on the payroll as was used to calculate the loan, it required a business to rehire the same number of full-time employees or full-time equivalents by June 30, 2020. The only exception to this rule was if an employer could document in writing an attempt to rehire an employee who rejected this offer.

The new law makes two significant changes to these requirements. First, it extends the rehire date to December 31, 2020, and second, it adds additional exceptions for a reduced head count. The law states a business can still receive forgiveness on payroll amounts if it:

- Is unable to rehire an individual who was an employee of the eligible recipient on or before February 15, 2020;

- Is able to demonstrate an inability to hire similarly qualified employees on or before December 31, 2020; or

- Is able to demonstrate an inability to return to the same level of business activity as such business was operating at prior to February 15, 2020.

5. PPPFA extends the repayment term from 2 years to 5

The new law eases repayment terms in the event loans or portions of them are not forgiven. A business now will have five years at 1% interest to repay the loan. Further, the first payment will be deferred for six months after the SBA makes a determination on forgiveness. Since under current regulations your bank has 60 days to make a forgiveness determination and the SBA an additional 90 days, this means you could have up until May of 2021 to make the first payment on the loan.

FOR THE FULL ARTICLE FROM FORBES, CLICK HERE

- Please click the link below for the letter that was sent to Governor Kay Ivey Friday, April 17th, from the Vestavia Hills Chamber of Commerce.

LETTER TO THE GOVERNOR FROM THE VESTAVIA HILLS CHAMBER OF COMMERCE

OVERVIEW OF THE LOAN PROGRAMS FOR COVID-19

Alabama Small Business Development Center (ASBDC) - Latest information on Economic Injury Disaster Loan (EIDL)

Alabama Small Business Development Center (ASBDC) - Latest information on Paycheck Protection Program (PPP or also called P3)

How to Get a PPP Loan or a SBA Coronavirus Emergency Loan

The Coronavirus Aid, Relief, and Economic Security Act sets aside $350 billion for small business loans to provide economic relief in 2020 and additional funds are anticipated to be made available by Friday, April 24, 2020. Application packets are anticipated to be re-opened at that time.

Click here for information that is needed

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed to help businesses, families, and individuals make ends meet during the coronavirus crisis.

Paycheck Protection Program (PPP)

The emergency loans provision of the CARES Act, also known as the Paycheck Protection Program, lets small businesses borrow as much as $10 million with an interest rate no higher than 4%. These loans, backed by the Small Business Administration (SBA), can be forgiven as long as your company meets certain conditions, including maintaining or restoring your average payroll. This means that, with the right planning, your loan can effectively be a grant.

For help and guidance with the application, contact your banker. The application can be obtained by clicking here

This guide explains which companies are eligible for these new loans, what lenders will be looking for from your company, how much you can borrow, how to have the loan forgiven and more.

**The expanded EIDL loan program also offers up to a $10,000 emergency cash advance that may not need to be paid back.

Economic Injury Disaster Loans (EIDLs)

On top of the new Paycheck Protection Program, the CARES Act expands the existing Economic Injury Disaster Loans (EIDLs) program that is also maintained by the SBA. The CARES Act opened EIDL loans to more types of small businesses, made it easier to apply and ensured that EIDLs smaller than $200,000 can be approved without a personal guarantee.

The expanded EIDL loan program also offers up to a $10,000 emergency cash advance that may not need to be paid back. During the recent National Small Business Town Hall, Neil Bradley, executive vice president and chief policy officer at the U.S. Chamber of Commerce, said businesses that apply for EIDL loans should be able to get a cash advance within three days of applying.

What should I do next?

While all of this information is important, if you do think you’ll be seeking an EIDL loan, it would be smart to get in touch as soon as possible with your local SBA district office or ask your bank if they are a preferred lender. Many of the banks will either have a SBA department OR will have a relationship with a preferred SBA lender so your best move would be to contact your banker for guidance.

If you are applying for the Paycheck Protection Program (PPP) loan, contact your bank right away that you do business with for guidance.

Birmingham area SBA office contact info is:

ALABAMA DISTRICT SBA OFFICE

2 North 20th Street Suite #325

Birmingham, AL 35203

205-290-7404

- The Chamber is continuing to talk with our local businesses to try to keep a handle on how they are modifying their business. IF you haven’t updated us, please send any pertinent info to chamber@vestaviahills.org In the meantime be sure to check out our local businesses and how they are serving our community by going to our Shop Local Guide AND you can also check out this info on Facebook by clicking here

- The City has also been doing a great job of providing alerts for all the various entities that you will want to bookmark and check out often. It can be found by clicking here This is great information for many functions in one place!

- Stay safe, wash your hands often, don’t touch your face and remember that things are changing rapidly so information that is accurate right now may (and probably will!) change by tomorrow so make sure and look at the appropriate websites for up to date information.

- University of Alabama Start-Up Safety Information: click HERE

- As restrictions on non-essential businesses and operations are eased, more companies will be entering “restart” mode. Before you get to that point, now would a good time to begin assessing your facility’s safety and health readiness for resuming operations. Through UA SafeState, you can get free Health and Safety Consultations to help with your planning. We can accommodate both virtual and on-site consultations, or a blended option. Our on-site work plan is carried out with social distancing and work practices to protect you and us throughout the process. For more information on our free consultation services, visit our UA SafeState OSH consultation website .

The U.S. Small Business Administration (SBA) issued a statewide declaration for Alabama which opens the Economic Injury Disaster Loans to eligible small businesses in the state. This program offers low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19).

Eligibility:

- SBA’s Economic Injury Disaster Loans are available to small businesses (as defined by industry NAICS codes), small agricultural cooperatives, small aquaculture businesses and most private non-profit organizations that have suffered working capital losses due to the declared disaster.

Loan Information:

- SBA’s Economic Injury Disaster Loans offer up to $2 million in assistance per small business. These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact. The interest rate is 3.75% for small businesses. The interest rate for non-profits is 2.75%.

- SBA offers loans with long-term repayments in order to keep payments affordable, up to a maximum of 30 years.

Application:

Find more information regarding the SBA’s Economic Injury Disaster Loans at: SBA.gov/Disaster.

Additionally, the Alabama Small Business Development Center (ASBDC) is an official outreach partner of the SBA and can serve as a resource regarding these loans. Please visit their website for information including a webinar that has more information on the application process.

FACT SHEET

Dated: 03/20/2020

To protect each borrower and the Agency, SBA may require you to obtain and maintain appropriate insurance. By law, borrowers whose damaged or collateral property is located in a special flood hazard area must purchase and maintain flood insurance. SBA requires that flood insurance coverage be the lesser of 1) the total of the disaster loan, 2) the insurable value of the property, or 3) the maximum insurance available.

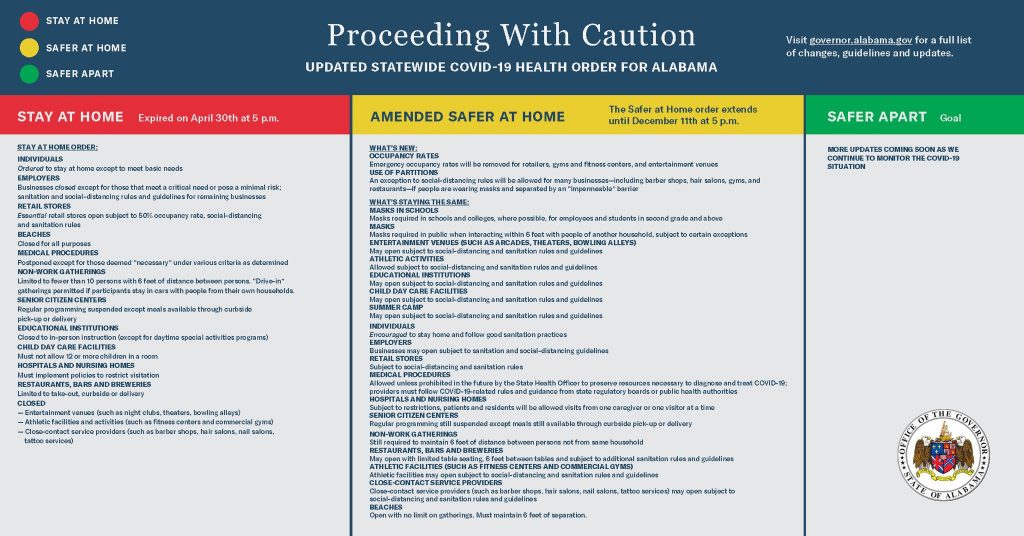

Click here for the November 5, 2020 Amended Alabama Safer at Home Order. The current Order expires at 5 pm on December 11, 2020.

State of Alabama

Read the full ordinance here.

Effective July 16, 2020 at 5:00 P.M., each person shall wear a mask or other facial covering that covers his or her nostrils and mouth at all times when within six feet of a person from another household in any of the following places: an indoor space open to the general public, a vehicle operated by a transportation service, or an outdoor public space where ten or more people are gathered. But this facial-covering requirement is subject to the following exceptions.

a. Exceptions for practical necessity. The facial-covering requirement does not apply to:

(i) Any person six years of age or younger;

(ii) Any person with a medical condition or disability that prevents him or her from wearing a facial covering;

(iii) Any person while consuming food or drink, or seated at a restaurant to eat or drink;

(iv) Any person who is obtaining a service (for example, a medical or dental procedure) that requires removal of the facial covering in order to perform the service; or

(v) Any person who is required to remove the facial covering to confirm his or her identity, such as for security or screening purposes.

b. Exceptions for exercise. The facial-covering requirement does not apply to:

(i) Any person who is actively engaged in exercise in a gym or other athletic facility if he or she maintains six feet of separation from persons of another household;

(ii) Any person who is directly participating in athletic activities in compliance with paragraph 11 of this order; or

(iii) Any person who is in a swimming pool, lake, water attraction, or similar body of water, though wearing a face covering or social distancing is strongly encouraged if safe and practicable.

c. Exceptions for effective communication. The facial-covering requirement does not apply to:

(i) Any person who is seeking to communicate with another person where the ability to see the person’s mouth is essential for communication (such as when the other person has a hearing impairment); or

(ii) Any person speaking for broadcast or to an audience if the person maintains six feet of separation from persons from another household.

d. Exceptions to facilitate constitutionally protected activity. The facial-covering requirement does not apply to:

(i) Any person who is voting, though wearing a face covering is strongly encouraged; or

(ii) Any person who cannot wear a facial covering because he or she is actively providing or obtaining access to religious worship, though wearing a face covering is strongly encouraged.

e. Exceptions for essential job functions. The facial-covering requirement does not apply to:

(i) Any first responder (including law enforcement officers, firefighters, or emergency medical personnel) if necessary to perform a public-safety function; or

(ii) Any person performing a job function if wearing a face covering is inconsistent with industry safety standards or a business’s established safety protocols.

Masks or other facial coverings can be factory-made, homemade, or improvised from household items such as scarves, bandanas, or t-shirts. For instructions on how to make a facial covering at home, see the Centers for Disease Control and Prevention (CDC)’s “How to Make Cloth Face Coverings,” available at https://www.cdc.gov/coronavirus/2019-ncov/preventgetting-sick/how-to-make-cloth-face-covering.html.

Jefferson County

Effective June 29, 2020, public establishments in Jefferson County will require persons to wear a face covering by order of the Jefferson County Health Officer. Read the full ordinance here.

Printable Sign to post on your door.

Defending Against Cyber Scams

The Department of Homeland Security Cybersecurity and Infrastructure Security Agency (DHS/CISA) warned individuals to remain vigilant for scams related to Coronavirus Disease 2019 (COVID-19). Cyber actors may send emails with malicious attachments or links to fraudulent websites to trick victims into revealing sensitive information or donating to fraudulent charities or causes. Exercise caution in handling any email with a COVID-19-related subject line, attachment, or hyperlink, and be wary of social media pleas, texts, or calls related to COVID-19.

CISA encourages individuals to remain vigilant and take the following precautions:

- Avoid clicking on links in unsolicited emails and be wary of email attachments. See Using Caution with Email Attachments and Avoiding Social Engineering and Phishing Scams for more information.

- Use trusted sources—such as legitimate, government websites—for up-to-date, fact-based information about COVID-19.

- Do not reveal personal or financial information in email, and do not respond to email solicitations for this information.

- Verify a charity’s authenticity before making donations. Review the Federal Trade Commission’s page on Charity Scams for more information.

- Review CISA Insights on Risk Management for COVID-19 for more information.

The FTC has a dedicated page: https://www.consumer.ftc.gov/features/coronavirus-scams-what-ftc-doing and local door-to-door scams are being reported in the press.

- Your Kid's Urgent Care offers curbside service for COVID-19 testing for BOTH children and adults. They accept insurance for testing.

- Urgent Care for Children offers curbside coronavirus testing for an adult or pediatric patient. To schedule a test, call their COVID-19 Hotline at 205-848-2273.

- Any Lab Test Now offers COVID-19 Antibody Testing.

- For more information on COVID-19 Antibody testing, see the following links:

Eighth Supplemental Emergency Proclamation (Liability Protections)

- Like other governors, Governor Ivey is providing safe harbor to health care providers, businesses, and other entities to encourage the reopening of our State.

- These protections recognize that we need these groups not only to get Alabama up and running again, but also to do so in a way that promotes public health and safety. To provide two examples:

- The order protects health care providers from a frivolous lawsuit based on actions they took or failed to take as a result of the COVID-19 pandemic.

- The order protects businesses from frivolous lawsuits when they conduct COVID-19 testing or distribute PPE to help protect people from COVID-19.

- Importantly, the order in no way shields these groups from claims of egregious misconduct. Claims based on egregious misconduct would be allowed to proceed.

- The order is based on two aspects of the Emergency Management Act:

- The Act itself grants immunity in certain instances where people or companies are trying to comply with the state’s emergency orders.

- The Act also gives the governor power to take steps necessary to promote and secure the safety and protection of the public. Like the other governors who have extended these protections, Governor Ivey certainly believes that these reasonable, common-sense protections for these groups will promote the safety and security of the general public.

For the FULL State of AL Proclamation by the Governor, click HERE

October 20, 2020

Alabama Small Business Development Center Network

IF your business applied for a Paycheck Protection Program (PPP) and it was $50,000 or less, you need to be aware of a new ruling that has come out (see below) and be sure to contact your banker and/or accountant for additional guidance:

from the Alabama Small Business Development Center Network

PPP Forgiveness Update

Was your PPP loan under $50,000? We have good news:

SBA and Treasury Announce Simpler PPP Forgiveness for Loans of $50,000 or Less

Here are the highlights:

- SBA Form 3508S requires fewer calculations and less documentation for eligible borrowers.

- Borrowers that use SBA Form 3508S are exempt from reductions in loan forgiveness amounts based on reductions in full-time equivalent (FTE) employees or in salaries or wages.

- SBA Form 3508S also does not require borrowers to show the calculations used to determine their loan forgiveness amount. However, SBA may request information and documents to review those calculations as part of its loan review process. (Keep your documentation!)

If your loan qualifies, and you are ready to dispose of this loan:

- Contact your lender to determine how to proceed.

- Download the Simplified Forgiveness Application Form (#3508S version 10/20)

- Review the forgiveness application instructions.

If you are not eligible to use this form, you must apply for forgiveness of your PPP loan using SBA Form 3508 or 3508EZ (or your lender’s equivalent form). While some lenders have started processing forgiveness applications, other are waiting to see if Congress will take additional actions to streamline the forgiveness process (for borrowers and lenders alike).